The Netherlands is home to industry giants like ASML, NXP, and ASM, all well-known for their chip technology innovation.

Key players in the Dutch semiconductor landscape include:

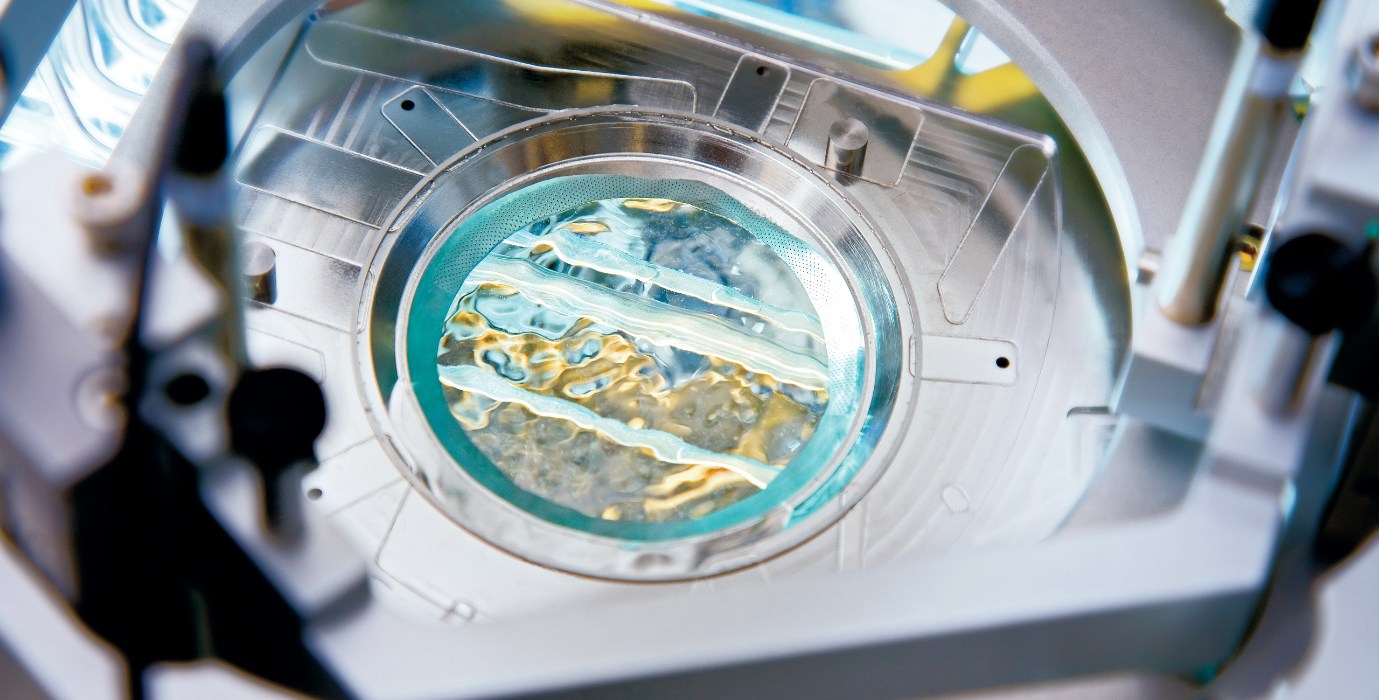

ASML: A global leader in photolithography equipment with a 90% market share, ASML is the only company capable of producing EUV lithography machines for advanced semiconductors. It is the largest semiconductor company in the region by market value (€275 billion) and employs around 39,000 people worldwide.

NXP Semiconductors: A substantial innovator in the automotive, industrial, and IoT sectors, NXP holds 10.8% of the global automotive semiconductor market. In 2023, it reported $13.2 billion in revenues and employs 31,000 people globally, with its Eindhoven campus as a powerful R&D hub.

Besi (BE Semiconductor Industries): Besi specializes in semiconductor packaging and assembly and holds 39% of the global Die Bonder Equipment market. It reported €1.42 billion in revenues in 2023, with a significant focus on high-performance computing and 5G applications.

ASM International: Known for wafer processing equipment, ASM holds 55% of the atomic layer deposition (ALD) market. In 2023, it achieved €2.68 billion in revenue, driven by demand for advanced deposition technologies in chip production.

“The Netherlands is globally recognised for its unique strength in developing advanced semiconductor equipment and its strong, collaborative high-tech ecosystem.”

Marsha Nieuwland, Consultant, TNO

These companies, with numerous small and medium-sized enterprises, form a robust ecosystem, contributing significantly to national and global markets and maintaining the country’s leadership in the semiconductor value chain.

Despite the Netherlands’ leadership in semiconductor technology, its dependency on a few large companies, especially ASML, poses a vulnerability. To mitigate this challenge, the country fosters collaboration through research clusters, integrating government, industry, academia, and civil society in a Quadruple Helix approach. This strategy aims to diversify the sector, drive innovation, and ensure long-term growth. Alongside a robust ecosystem of small and medium-sized enterprises, these efforts strengthen the Netherlands’ semiconductor leadership and attract further investment.